|

Roche Farm & Garden

Market Data

News

Ag Commentary

Weather

Resources

|

Will Ford Cut, Maintain, or Increase Its Dividend in 2025?/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

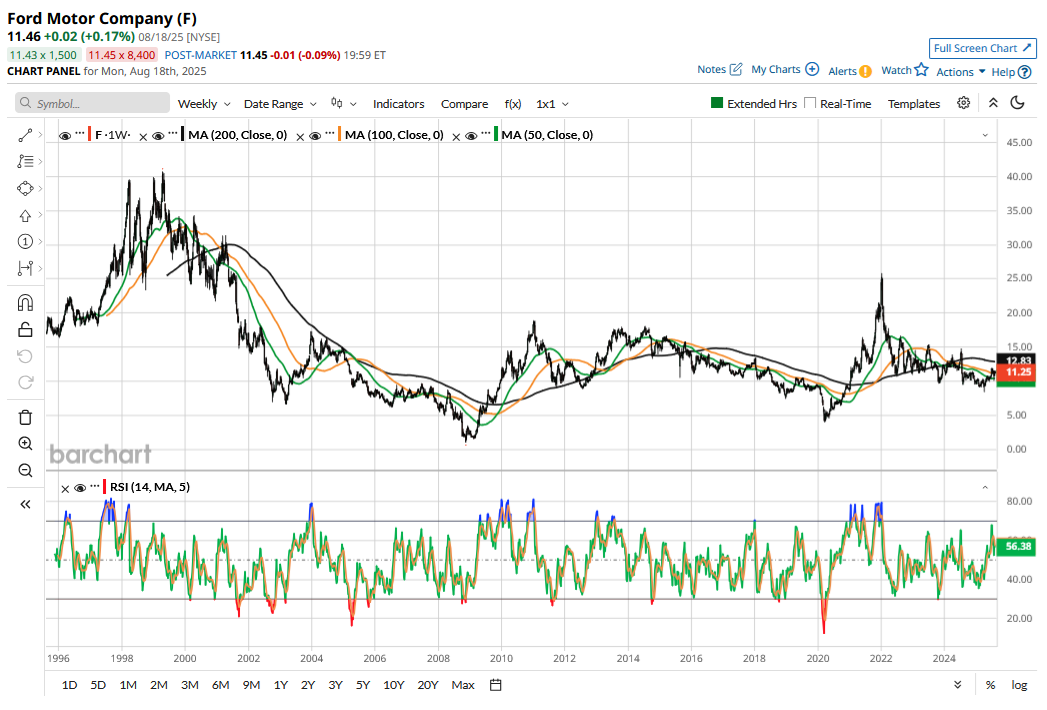

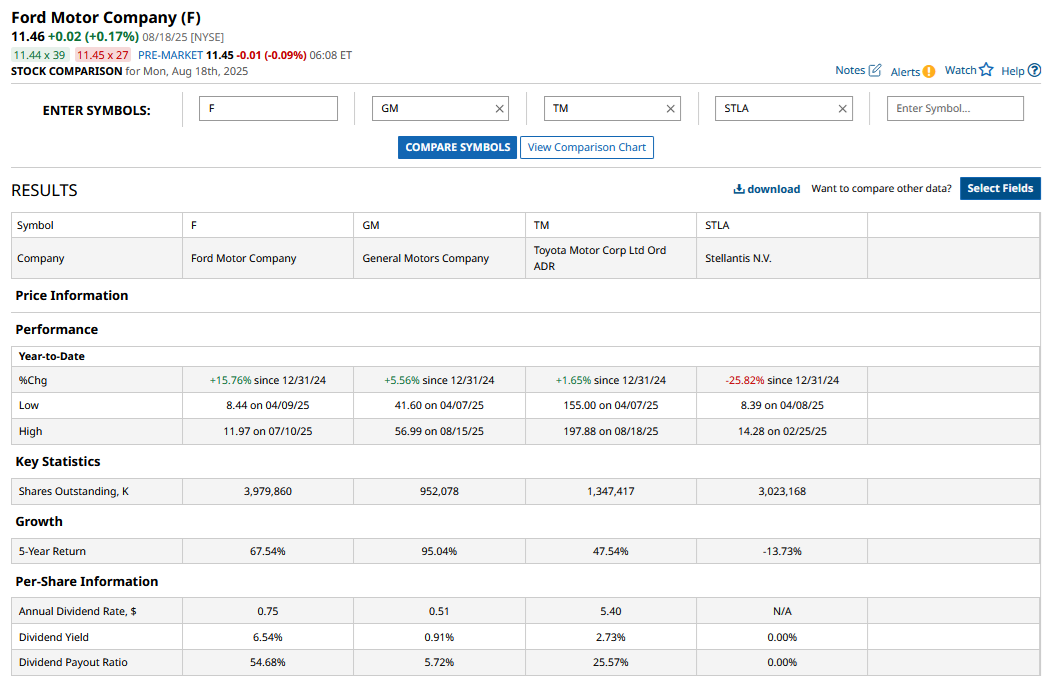

With a dividend yield of 5.2%, Ford (F) has one of the highest dividend yields among S&P 500 Index ($SPX) constituents. However, the company hasn’t increased its regular dividends since 2022. In this article, we’ll look at whether Ford will increase its dividend or rather cut it amid the hit from President Donald Trump’s tariffs. To begin with, let’s look at the recent history of Ford’s dividend. Ford announced a dividend of $0.15 per share in January 2020, which was suspended as quickly as March of that year, amid the COVID-19 pandemic.  However, Ford’s dividend was restored in October 2021, with a quarterly payout of $0.10 per share. The company increased its payout by 50% and announced a quarterly dividend of $0.15 in July 2022 as its earnings and cash flows rebounded. The company has since maintained the same quarterly dividend. Ford intends to return between 40% and 50% of its free cash flows to shareholders, and the company has been paying special dividends to help reach its distribution targets. This year, Ford paid a supplemental dividend of $0.15 to mark the company’s third consecutive special dividend, after dishing out $0.18 last year. Ford paid a special dividend of $0.65 in 2023, which it attributed to the return on its investment in electric vehicle startup Rivian (RIVN). Ford’s Cash Flows Have Been StagnantSince Ford’s dividends are dependent on its free cash flows, it would be prudent to look at that metric. Ford generated adjusted free cash flows of $6.7 billion last year, while the corresponding numbers in 2023 and 2022 were $6.8 billion and $9.1 billion, respectively. The spike in 2022 free cash flow was on account of the Rivian stake sale. Ford’s adjusted cash flows were similar in the previous two years, which explains the stagnant regular dividend. For 2025, Ford has forecast free cash flows between $3.5 billion and $4.5 billion. The guidance assumes a net hit of $2 billion from Trump’s tariffs. Detroit rival General Motors (GM) expects a gross tariff impact of between $4 billion and $5 billion but is hopeful of mitigating 30% through cost cuts, adjustments to manufacturing, and pricing actions. Here, it is worth noting that the tariff situation has been quite fluid. Moreover, other factors like the macro situation, including interest rate changes, will have influence on Ford’s guidance. Ford has around 4 billion outstanding shares, and to maintain the current quarterly payout of $0.15 ($0.60 annually) it would have to pay around $2.4 billion as dividends in 2025. If the company were to meet the midpoint of its guidance, it would imply a payout ratio of 60%, which is higher than the targeted range.  Ford Might Weigh Adjusting Its Dividend in 2026Earlier this month, Ford announced further investments to build a $30,000 electric pickup, which it hailed as its next Model T moment. The company, like other automakers, might need to increase its U.S. manufacturing and sourcing footprint as Trump pushes for onshoring, which could mean higher capex. Even though maintaining the 2025 dividend could mean that Ford might need to overshoot its payout targets, I don’t expect the company to slash its dividend this calendar year. That said, a hike looks to be off the table. However, if the tariff situation does not improve in Ford’s favor or the automotive market fundamentals, particularly on pricing, worsen in 2026, Ford might struggle to continue with the current payout, and at some point, management might need to reconsider its strategy. On the date of publication, Mohit Oberoi had a position in: F , GM , RIVN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|